Solar Tax Credits Before and After 2019

What a century this has been so far! We saw broadband internet become the norm worldwide, the first artificial self-regulating heart was created, mobile phones overtook traditional computers and 3D printing went mainstream. In this long list of accomplishments, we can also add the federal tax credit for solar power also known as Investment Tax Credit (ITC). Introduced in 2005, the legislation forwarded a 30% discount to residential and commercial consumers of solar power systems from 2005 through 2020 when it would drop to 26%. The credit will then be reduced to 22% in 2021 and 10% in 2022 moving forward.

Clearly then, 2019 is an important period for solar power as it is the last year when consumers can enjoy a 30% rebate on their purchase. Here’s all you need to know about the ITC and what you can expect down the line…

What is the Solar Tax Credit?

The ITC is a dollar for dollar reduction of the income tax you owe upon purchasing a solar power system. It’s different from a discount as people have to be paying taxes to be eligible. However, since most people do pay tax, their eligibility is implied. So, if you purchase a system in 2019 worth $10,000 you can claim a $3,000 credit. You will need to own the system in order to do so, though. Some of the expenses you are allowed to claim the tax credit against are:

- Solar equipment

- Hiring a contractor

- Shipping

- Consulting fees

- Professional installer fees

- Electrician fees

- Engineer fees

- Tools bought or rented

- Wiring, screws, bolts, nails, etc.

- Equipment purchased or rented (scaffolding or a man-lift, for example)

- Permitting fees

- Permitting service costs

The move was aimed at spurring demand in the renewable energy market and has been one of the primary drivers of growth in solar power, particularly photovoltaic.

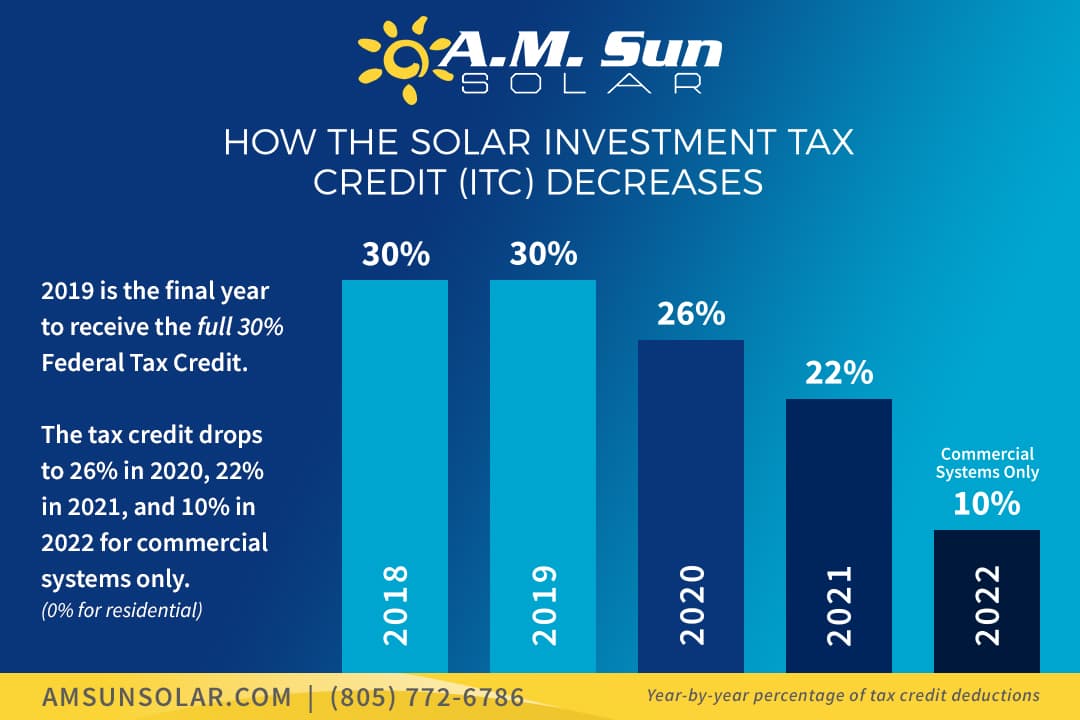

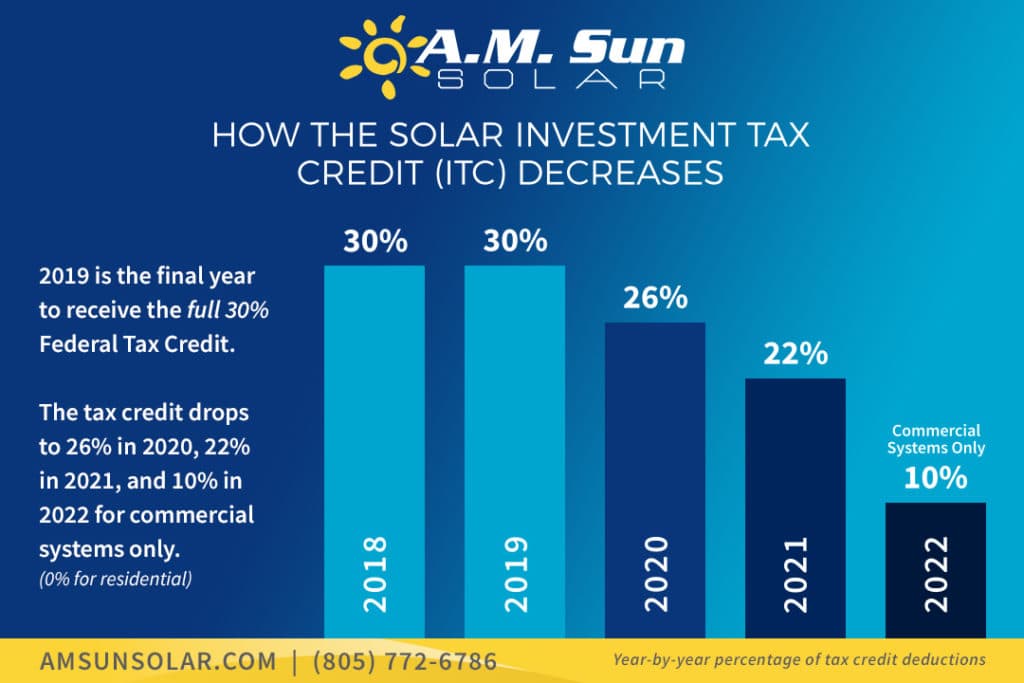

Solar Tax Credit Schedule

Legislations such as the ITC are aimed at helping new industries find their footing, and as such are valid for a limited time only. The ITC down schedule is as follows…

- 2005-2019: 30%

- 2021: 22%

- 2022: 10%

The 2022 10% credit limit is only valid for commercial and industrial purchases though. The credit for residential consumers will be dialed down to zero from that point on.

What Can We Expect When the ITC Starts Declining?

Obviously, you will see a 4% increase in solar prices if you purchase a solar power

The ITC is extended again: The tax credit was due for removal in 2016, however, Congress opted to extend it to 2019. So, there’s always the chance it may happen again. This is unlikely though as there is a step-down procedure detailed. A lot will depend on the political climate and how good an argument solar proponents and consumers can make. Only time will tell.

Residential consumers are included in the 10% credit post 2022: While the ITC is expected to be nil for consumers after 2022, Congress can always re-include them.

States take the batton forward: While the ITC is offered by the Central government, there are various state government initiatives as well. California, for instance, has the 100% Renewable Portfolio Standard which requires the state to get 60% of its energy from renewable sources by 2030. More states can follow suit, taking the burden off from the central government.

Is a 4% Reduction That Big a Deal?

At first glance, the 26% figure doesn’t seem to be all that big of a difference. A typical 5 kW power system today costs $15,250, and $10,675 after tax. All things being equal, a homeowner looking to install the same after Jan 1st will be paying $11,285 instead.

While a $610 difference is certainly not going to make a dent in the universe for most people, the question remains — why pay it at all if you could simply avoid it by acting early. A lot will depend upon the size of your solar power system, too. Obviously the more powerful a system you opt for, the greater the difference will be, so, a lot will depend on your energy requirements.

How Can I Claim the Tax Credit?

You can only enjoy the tax credit if your solar power system has been fully installed and paid for in 2019. While there is no need for concern just yet, remember that getting quotes, financing, utility approval, property survey and getting the system installed on your premise is a time-consuming process. So, the sooner you start the better.

Once all that’s done, however, you will need to fill out and submit IRS Form 1040 and 5695 – Residential Energy Credits to initiate the credit. You will also need all the receipts of your solar power installation so, do keep them in a safe place.

Concluding Thoughts

The ITC has been an incredible enabler for the solar industry. It spurred demand like never before and solar adoption has been increasing at a breakneck speed year on year. Even so, it’s truly unfortunate to see support for promising, limitless, clean sources of free energy come and go, while oil and coal continuing to enjoy federal subsidies even though they’re well over 100 years old now.

For instance, did you know that government issued tax breaks for fossil fuels, one of which is over a century old outweigh the same for renewable energy seven to one and are alive and kicking to this day? One might wonder why this is being condoned when fossil fuel power sources have matured significantly and should be allowed to try their hand in a free market now. If not, then why not treat renewables the same way? Join the war to save renewable energy. Educate yourself on the workings of energy politics and speak with your senator. We still have a fighting chance.

If you’d like to know more about the tax credit work, feel free to call us at 805-772-6786 and we will be glad to help! If you’re ready to get started on your own solar energy system, click here to request your free consultation.