Whether you are a homeowner or company in the United States, installing solar is now more affordable with the solar tax credit. The objective of the solar investment tax credit is to incentivize the use of rooftop and utility-scale solar energy in the United States.

The investment tax credit, or federal solar tax credit, gives you 30% of your solar costs back as a credit on your federal tax returns, effectively reducing your solar system costs.

Every person who owns a solar system, whether for residential property under Section 25D or commercial property under Section 48, is eligible for the solar tax credit unless they signed a power purchase agreement or lease their solar panels.

You can claim 30% of your solar costs, regardless of the size of your solar investment. Since the claim is a credit and not a refund, you must have a federal tax liability that is larger or equal to 30% of your solar system cost to claim the tax credit in one year.

You can, however, claim segments of your tax credit over five years if the amount you owe in federal taxes is less than 30% of your system costs.

For example, if your solar system costs $30,000, you can claim 30% or $9,000 as a tax credit. If you only owe $6,000 in federal taxes, however, you will owe zero federal taxes for that year, and you will be able to claim $3,000 tax credit in the following year.

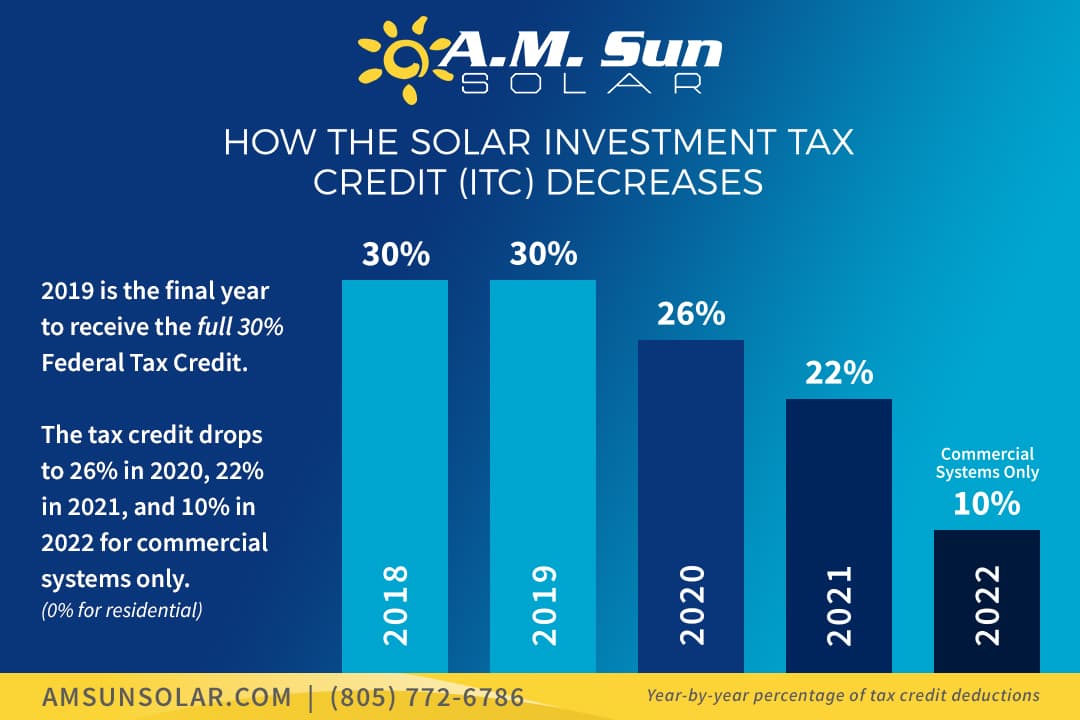

In the above example, your solar system will cost you $21,000 instead of $30,000. The solar investment tax credit will change over time. Congress extended the tax credit at 30% through 2019.

In 2020, the tax credit will step down to 26%, and in 2021, the tax credit will go down further to 22%. From 2022, the credit will not be available to homeowners anymore, but owners of commercial solar systems will still be able to claim a 10% tax credit.

Another benefit of the solar investment tax credit is that it applies to all the costs involving your solar system. For example, if you have to upgrade your roof to accommodate your PV panels, you can claim the 30% tax credit on the cost of the portion of the roof that is fitted with solar components.

Taking advantage of the solar investment tax credit as soon as possible helps you save more on your solar system costs. It also helps with expenses for the structural improvements necessary to accommodate the system components, especially since the claim percentage will go down over the following years,

You claim investment tax credit for solar when you file your annual federal tax return. Claiming the investment tax credit is straightforward. To submit a claim, complete IRS Form 5695 titled “Residential Energy Credit” along with IRS Form 1040.

As an everyday consumer, the solar investment tax credit can save you thousands of dollars. Consult with a tax professional to assist you with the claim.

If you haven’t had your house qualified for a solar energy system and the savings that come with it, click here to request your free consultation today or call (805) 772-6786.

Benefits of the Solar Investment Tax Credit for the Everyday Consumer